TASCollect Ezine

Working in the local economy means TCS is always abreast of local economic challenges and the issues impacting Tasmanian business.

We understand the challenges you and your business face, which is why we aim to provide articles to share our knowledge with you and assist you and your business to make the best credit related decisions and lessen the risk of incurring bad debt where possible.

We provide our clients with our quarterly TASCollect ezine, which features articles to assist you in with your credit management practices. We have provided a selection of these articles below.

Poor accounts receivable practices such as extending credit to unqualified customers, not collecting the correct customer information, not invoicing regularly, failing to follow up on overdue invoices or not following through when questions are raised by customers can all contribute to the erosion of an organisation’s major asset. Its debtors ledger.

Poor accounts receivable practices such as extending credit to unqualified customers, not collecting the correct customer information, not invoicing regularly, failing to follow up on overdue invoices or not following through when questions are raised by customers can all contribute to the erosion of an organisation’s major asset. Its debtors ledger. When you refer a debt for collection it is important to note that except in certain circumstances recovery action should not be pursued against a “minor” – that is a person under the age of full legal responsibility.

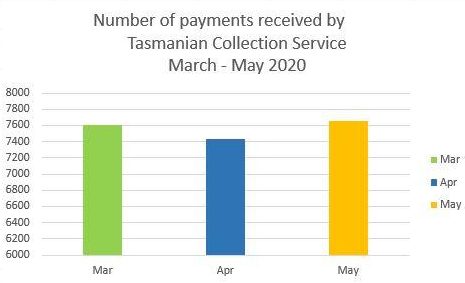

When you refer a debt for collection it is important to note that except in certain circumstances recovery action should not be pursued against a “minor” – that is a person under the age of full legal responsibility. Despite troubling times we have not seen a huge drop in the number of payments made during the pandemic period of March – May 2020. We noted a small variance in April, in the number of payments received but this recovered in May.

Despite troubling times we have not seen a huge drop in the number of payments made during the pandemic period of March – May 2020. We noted a small variance in April, in the number of payments received but this recovered in May.