The Equifax Consumer Credit Demand Index: Q4 2022 |

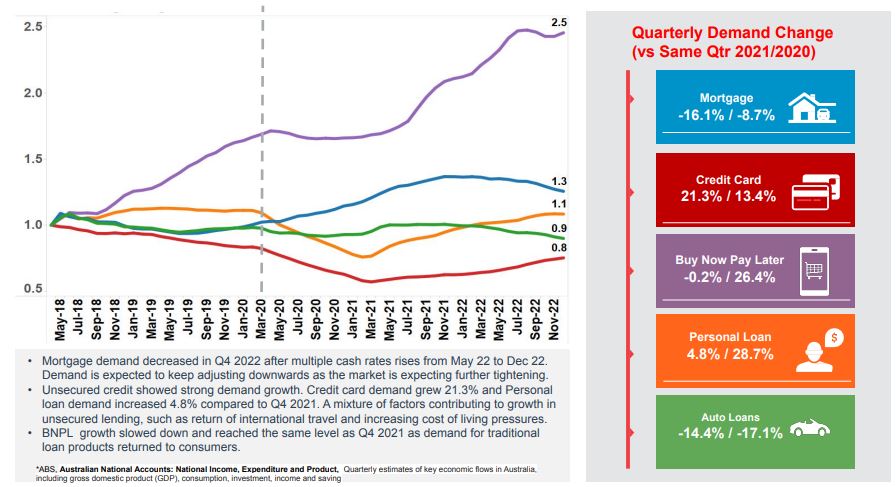

Snapshot –Consumers turn to credit cards as the cost of living increases. Mortgage demand continues to fall, while personal loan arrears suggest further financial turbulence ahead. Other highlights include:

Source – Equifax – https://www.equifax.com.au/business-enterprise |