“Australian home builders are still struggling to complete the enormous pipeline of work they accumulated over the last two years,” stated HIA Economist, Tom Devitt.

The ABS today released its building activity data for the June Quarter 2022. This data provides estimates of the value of building work and number of dwellings commenced, completed, under construction and in the pipeline, across Australia and its states and territories.

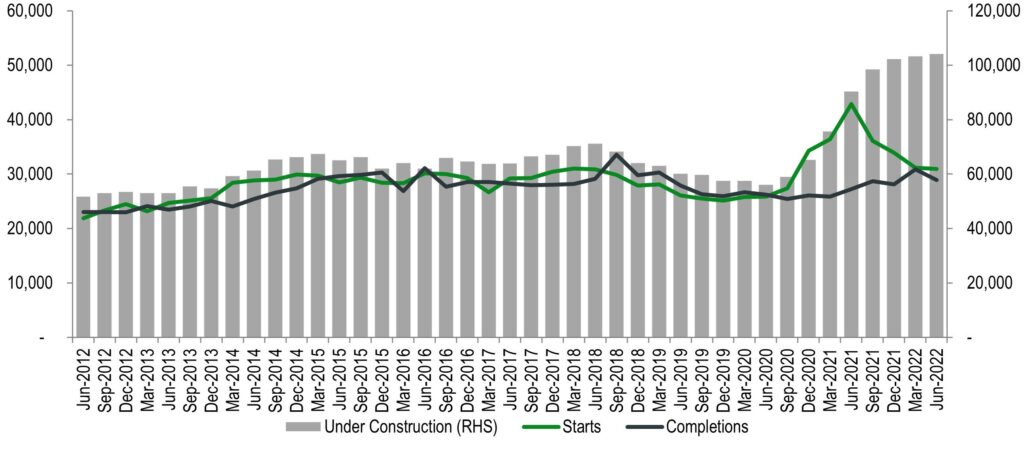

“There were only 28,898 detached houses completed in the June Quarter 2022, 6.3 per cent down from the previous quarter,” added Mr Devitt.

“In contrast, there were 30,926 new detached houses that commenced construction in the June Quarter 2022. While this is down by 0.8 per cent on the previous quarter and 27.9 per cent from the peak a year earlier, it is still 18.7 per cent more than the same quarter in 2019, pre-pandemic.

“With more houses still being commenced than completed, Australian home builders now have 104,228 detached houses under construction, a record pipeline that is 81.2 per cent larger than what existed pre-pandemic.

“Supply constraints are continuing to hold back completion of these projects. Materials constraints have plagued builders over the last two years, and shortages of skilled trades have only become more acute.

“These supply constraints will keep Australia’s home builders busy this year and next as they continue to work down this record volume of detached house projects.

“In addition to this, the multi-units market is also continuing to strengthen. Multi-unit commencements declined by 6.0 per cent in the June Quarter 2022 to 16,966 but this is still up on the lows of 2020. Improvement has been seen in both high-rise and medium density units.

“With interest rates and the cost of building increasing rapidly, affordability constraints will increasingly push home buyers back towards more affordable, higher density living and with the return of migration, demand for units should continue to strengthen.

“This increasing activity in the multi-units market, combined with ongoing activity in the detached market, will sustain elevated demands for skilled trades and obscure the effects of increasing interest rates on the broader economy,” concluded Mr Devitt.

This article has been reprinted from www.hia.com.au with the express permission of Thomas Devitt, HIA Economist.